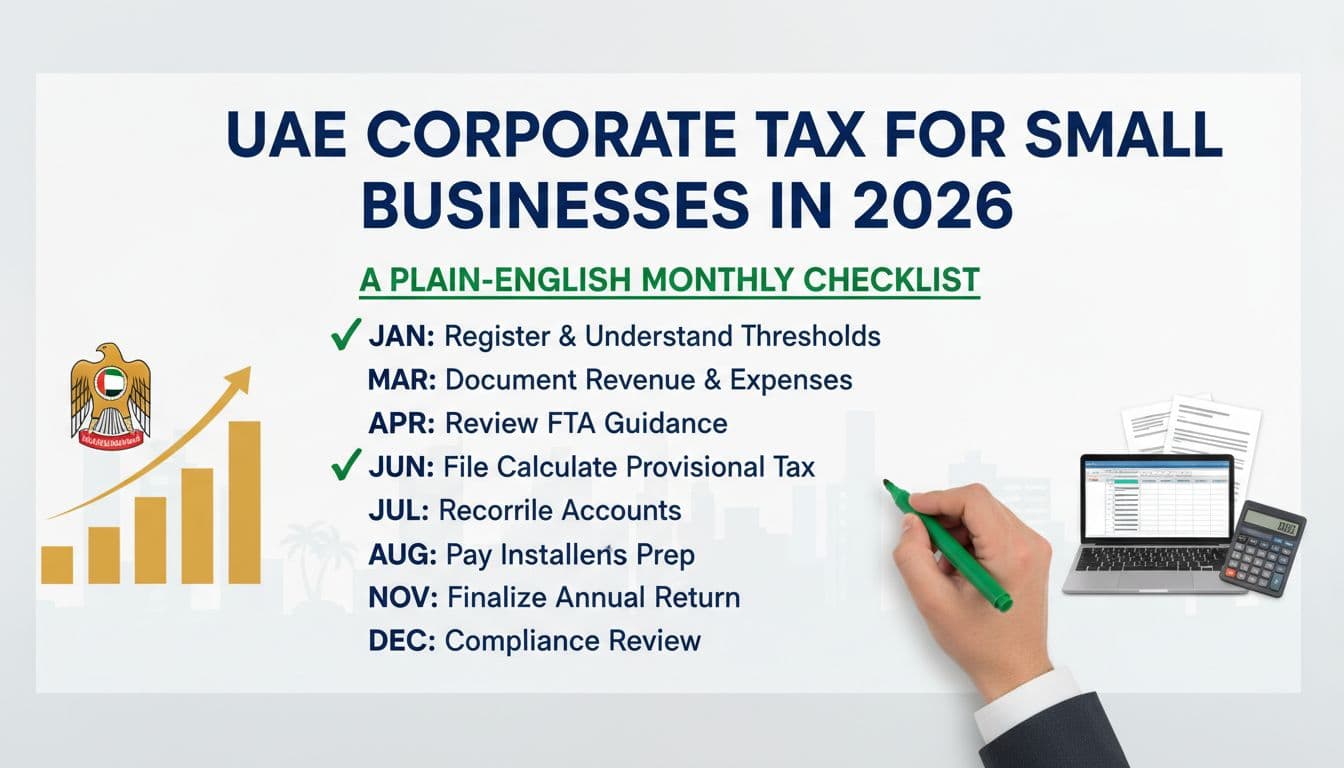

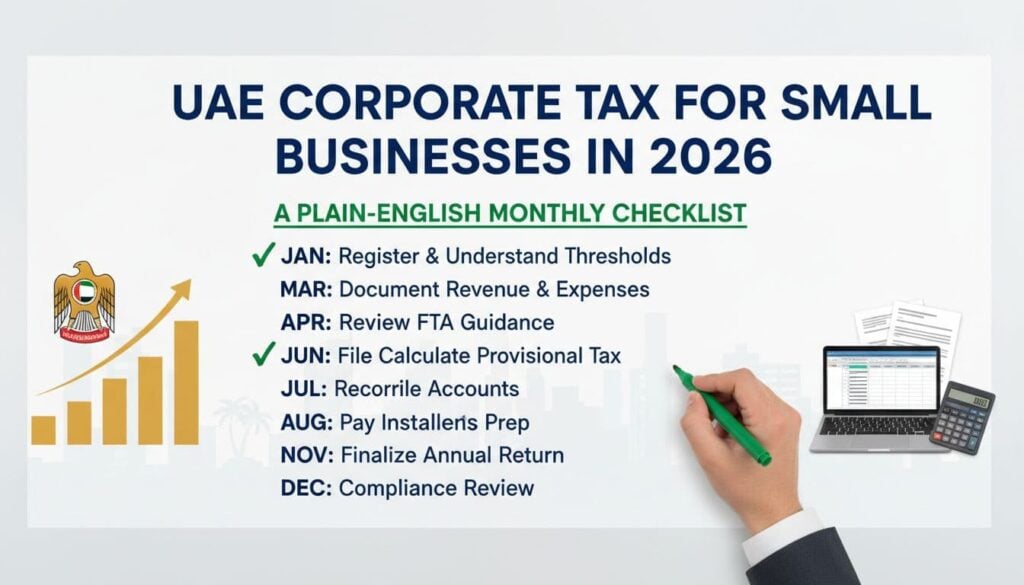

UAE Corporate Tax for Small Businesses in 2026: a plain-English monthly checklist

If we run a small business in Dubai, Abu Dhabi, Sharjah, or any other Emirate, UAE Corporate Tax overseen by the Federal Tax Authority can feel like a once-a-year storm. The problem is that storms don’t arrive without warning. They build up quietly through missed invoices, messy bank statements, and half-tracked expenses. Bookkeeping and accounting serve as the essential solution for managing business documentation and avoiding that storm.

The good news is that UAE Corporate Tax is manageable when we treat it like routine maintenance, not an emergency. In 2026, most of what keeps us compliant is simple monthly discipline, plus knowing which thresholds matter.

This guide gives a clear, practical checklist we can follow each month, with a few calendar prompts so nothing sneaks up on us.

UAE corporate tax basics for small businesses in 2026

Let’s ground ourselves in the rules that drive the monthly work.

The headline rates are straightforward: 0% corporate tax applies on Taxable Income up to the AED 375,000 threshold, and the 9% Corporate Tax Rate applies on Taxable Income above that. The rate is based on Taxable Income, not turnover.

For many micro and small firms, the bigger question is whether we can use Small Business Relief (SBR). If we’re eligible and we elect to use it, the relief can treat Taxable Income as nil for the Tax Period, which can mean no corporate tax is due for that Tax Period. In practical terms, it can remove the tax calculation burden, but it does not remove the need for proper records.

In 2026, Small Business Relief generally hinges on a few key points:

- Resident Person (the business is treated as a Resident Person for corporate tax purposes).

- Revenue of AED 3,000,000 or less in the current Tax Period and all previous periods up to 2026 (meeting the AED 3,000,000 revenue threshold).

- We’re not a member of a large multinational group.

- We’re not a Qualifying Free Zone Person for corporate tax purposes (Free Zone entities can differ).

Small Business Relief is available for Tax Periods ending on or before 31 December 2026, under the current relief window. For the most accurate wording, it’s worth keeping the official documents bookmarked, including Ministerial Decision No. 73 of 2023 on Small Business Relief and the Ministry of Finance corporate tax explanatory guide announcement.

One more point that affects our monthly habits: there’s no standard monthly corporate tax filing for most small businesses. The return and payment are generally due within the 9-month filing deadline after the end of the Tax Period, submitted through your Tax Registration Number on the EmaraTax portal. If our financial year ends on 31 December, that usually means a due date around 30 September the following year. The monthly work is about staying ready, keeping proof, and avoiding a painful clean-up later.

Monthly UAE corporate tax checklist (plain English, low stress)

Think of this as tidying the shop floor every day. We’re not redecorating, we’re just keeping it clean so customers (and auditors) can walk through safely.

Our core monthly tax compliance checklist

1) Close the month’s sales properly

Make sure every invoice and receipt is captured as part of solid bookkeeping and accounting, whether we run a café in Jumeirah, an online store shipping across the UAE, or a consultancy in Abu Dhabi Global Market. Missing sales records is one of the easiest ways to create problems later.

2) Categorise expenses while they’re still fresh

Don’t leave it to memory. Label costs by type (rent, utilities, marketing, software, delivery, subcontractors) as part of your bookkeeping and accounting routine. Distinguish between deductible expenses and non-deductible expenses. If something is partly personal, separate it now and keep a note. This is where “taxable profit” is made or lost.

3) Reconcile bank and cash

Match bank entries to invoices and receipts. If we handle cash (salons, workshops, small retail), do a simple cash count and record it. Treat petty cash like a real account, because it is.

4) Save evidence, not just totals

Totals don’t prove anything on their own. Keep supplier invoices, customer invoices, contracts, and payment confirmations to support your financial statements and monthly accounting records. Store them in a consistent folder structure by month. If we ever need to explain an expense, we’ll be grateful.

5) Track two thresholds every month

- AED 3,000,000 revenue threshold (SBR eligibility risk line).

- AED 375,000 taxable profit (0% band ceiling).

We don’t need perfect forecasting, but we do need awareness of our Taxable Income. A single strong quarter can change the picture fast, especially in seasonal sectors like tourism, events, and fit-outs.

6) Review “one-off” items before they become messy

Big equipment purchases, owner drawings, director loans, and deposits can confuse accounts. These may involve related party transactions, so flag them monthly, and ask our accountant early if we’re unsure.

If we want steady local leads while we stay organised with UAE Corporate Tax, it also helps to keep our business profile accurate on UAEThrive’s directory, and use the UAEThrive blog as a practical reference point for UAE business operations and growth.

A month-by-month checklist to stay compliant in 2026

The monthly routine stays similar, but each month has a “best use” focus. This keeps us moving forward, not just repeating admin.

| Month | What to focus on (quick reminders) |

|---|---|

| January | Confirm your tax period dates, tidy last year’s folders, check Small Business Relief revenue position. |

| February | Review recurring costs (rent, software), confirm contracts and invoices match, assess Small Business Relief eligibility. |

| March | Do a stock check if you hold inventory, review slow-moving items and write-offs. |

| April | Check staff costs and allowances, make sure payroll records are complete. |

| May | Scan for missing supplier invoices, chase them before summer travel starts. |

| June | Mid-year sense check: accounting profit trend, cash flow, and whether tax provisioning is needed. |

| July | Update expense policies (fuel, client meetings, phone), reduce “unclear” spending. |

| August | Clean up owner transactions, loans, and reimbursements, add notes and approvals. |

| September | If your year-end is 31 December, this is a good time to plan return prep early. |

| October | Review big projects and milestone billing, confirm revenue is recognised sensibly. |

| November | Lock down documentation, make sure agreements, payment proof, and Transfer Pricing documentation are easy to find. |

| December | Year-end close: final reconciliations, asset list updates, verify UAE Pass and Trade license for a clean handover to your accountant. |

Two practical tips that save hours

Keep one “tax file” list for the year.

It can be a simple checklist in a notes app: bank statements, sales reports, key contracts, asset purchases, loan schedules, and any unusual transactions. Add to it monthly.

Treat compliance like a habit, not a sprint.

The UAE’s corporate tax return filing deadline is tied to the tax period end (often a 9-month filing deadline). When our monthly records are neat with solid bookkeeping and accounting, filing becomes a formality for Taxable Persons, not a scramble that risks penalties and fines.

Conclusion

UAE Corporate Tax doesn’t need to dominate our calendar, but it does need a steady rhythm through consistent bookkeeping and accounting. For Taxable Persons, especially those dealing with Free Zone entities, identifying Qualifying Income is crucial to staying on track. If we reconcile monthly, track the AED 3 million and AED 375,000 lines, and keep evidence with our numbers via solid bookkeeping and accounting, we stay calm and prepared for Corporate Tax Return Filing, even as 2026 gets busy. Check the Federal Tax Authority website for the latest guidance.

Ready to get your business seen by more UAE customers while you keep operations in order? Add your company to UAEThrive here: Get your UAE business discovered for free.